dependent care fsa rules 2021

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. For dependent care FSAs you may contribute up to the IRS maximum limit unless your employer has set a lower limit.

Irs Notice 2021 15 Additional Relief For Coronavirus Disease Covid 19 Under Section 125 Cafeteria Plans Core Documents

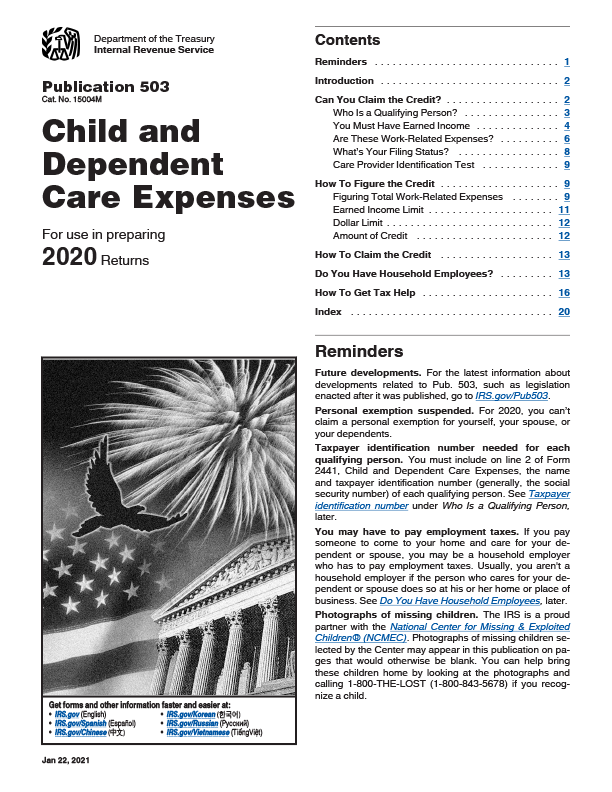

Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit.

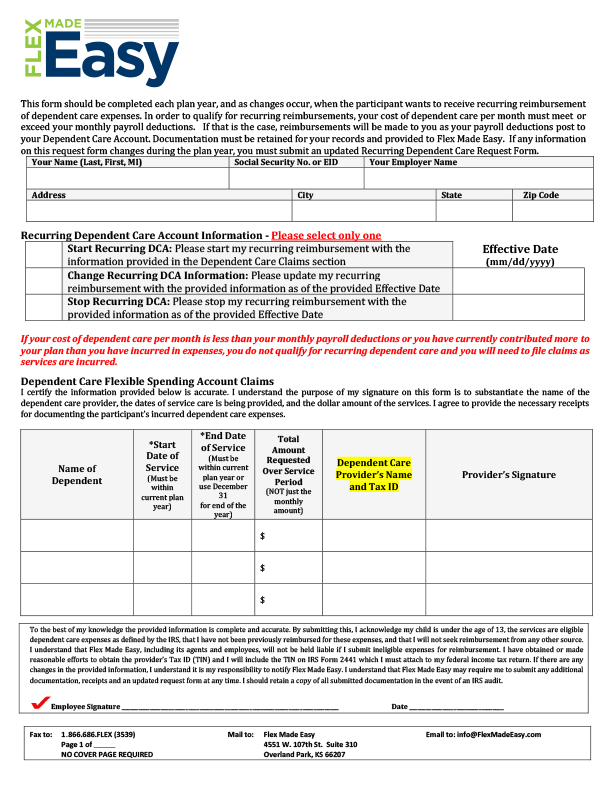

. Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. Double check your employers policies. Easy implementation and comprehensive employee education available 247.

Plan participants who stop participating in the plan during 2020 andor 2021 terminated participants may continue to be reimbursed for eligible expenses through the end of that plan year if they have unused. The limit will return to 5000 for 2022. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

If you want to make a change to your dependent care FSA elections please contact the OHR Benefits Department by submitting an inquiry online or by calling 833-852-2210. Get a free demo. Under the regular cafeteria plan rules dependent care FSAs are not permitted to include a carryover feature.

4000 from the 2020 plan year into the 2021 plan year and who elects to contribute 3000 to a dependent care FSA for the 2021 plan year will have 7000 ie 3000 election 4000 carryover available to pay dependent care. February 11 2021 2021-R-0054 Issue Explain federal rules that apply to health and dependent care flexible spending accounts also called arrangements including the use it or lose it rule and summarize any relief from the rules. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

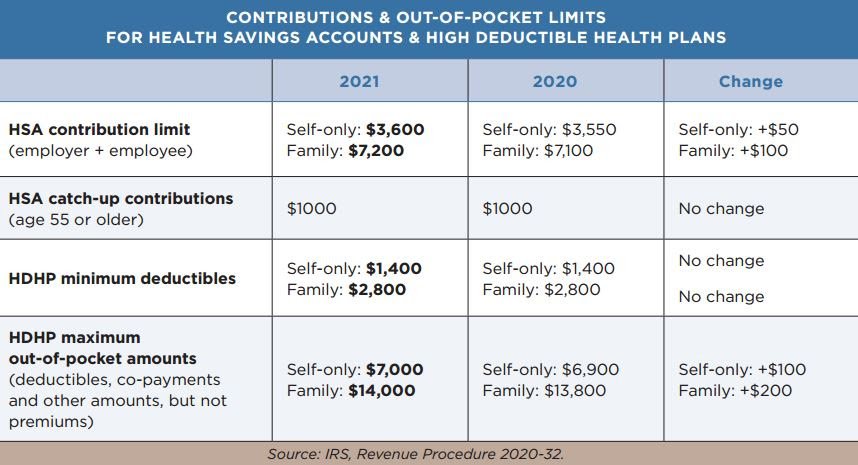

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Earlier in 2020 the IRS updated the rules to increase the maximum health FSA carryover from 500 to. If you have a dependent care FSA pay special attention to the limit change.

If you are divorced only the custodial parent may use a dependent-care FSA. The Taxpayer Certainty and Disaster Tax Relief Act. If a child turned 13 in the 2020 plan year AND the participant rolled over funds into.

Dependent Care FSA Eligible Expenses. ARPA Dependent Care FSA Increase Overview. Changes must be submitted no later than May 31 2021 to be accepted and processed for this plan year FY 21.

Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health FSA amounts and dependent care assistance program amounts to pay for or reimburse medical care or dependent care expenses. Ad Custom benefits solutions for your business needs. If you are married and filing separately you may.

Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. This was part of the American Rescue Plan.

However if you did not find a job and have no earned income for the year your dependent care costs are not eligible. How much can I contribute to my dependent care FSA. Included in the changes was the one-time change to the contribution limit for dependent care FSAs thats to say the contribution limit is not permanently changed but changed for 2021 only.

IRS contribution limits are 5000 per year if you are married and filing a joint return or if you are a single parent. Your employer may elect a lower contribution limit. Health and Dependent Care FSA Carryover.

If you are married and filing separately you may contribute up to 2500 per year per parent. Elevate your health benefits. For Dependent Care FSAs you may contribute up to 5000 per year if you are married and filing a joint return or if you are a single parent.

Dependent Care Tax Credit. Dependent Care FSA Increase Guidance. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck.

The limit is expected to go back to 5000. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. No election changes will be accepted after May 31 2021.

Employers can choose whether to adopt the increase or not. Unused health and dependent care FSA funds are forfeited at the end of the plan year known as the. PdfFiller allows users to edit sign fill and share all type of documents online.

The new contribution limit is 10500 for 2021 for single taxpayers and married filing jointly a limit that was previously set at 5000 per year. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday. Health and dependent care FSA grace periods for plan years ending in 2020 andor 2021 may be extended for up to 12 months after the end of the plan year.

With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. The most money in 2021 you can stash inside of a dependent-care FSA is 10500. For married couples filing joint tax.

A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time. ARPA automatically sunsets the increased dependent care FSA limit at the. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

Ad Download or Email FSA004 More Fillable Forms Register and Subscribe Now. For 2021 the dependent care FSA limit dramatically increased from 5000 to 10500 because of the American Rescue Plan Act of 2021 and that change has not been extended to 2022.

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Dependent Care Flexible Spending Accounts Flex Made Easy

Flexible Spending Accounts Ensign Benefits

Coronavirus And Dependent Care Fsa H R Block

Health And Dependent Care Fsas Relief For 2021 Captain Contributor

2021 Changes To Dcfsa Cdctc White Coat Investor

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Dependent Care Flexible Spending Accounts Flex Made Easy

Fsa Changes Eight Critical 2020 2021 Changes You Need To Know Chief Mom Officer

Irs Added Fsa Dependent Care Flexibility For Employee Benefit Plans Saxon Employee Benefits Insurance Wealth

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Changes To Dependent Care Fsas And What To Know

Don T Forget To File April 15 Is The Deadline To File 2021 Health Fsa Claims Ucnet

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services